The miracle and two lost decades

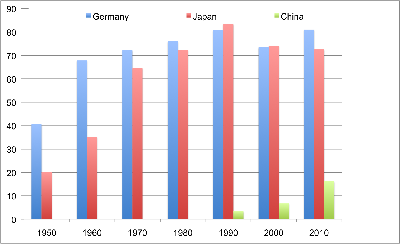

Japan's post-war economic development can roughly be divided into two phases - a miraculous economic and technological catch-up culminating in a real estate and stock market bubble followed by two decades of relatively poor economic performance. The two phases are well depicted by the movement of Japan's position of GDP per head relative to the US (see graph below). Japan started at 20% of the US and 50% of the German income level in 1950, had overtaken Germany by 1990 and reached 83% of the US level. However, after the burst of the bubble the country has steadily been loosing ground. In 2010, Japan's GDP per head had fallen below the German level and was at 73% of the US level. China, while rapidly catching up, is still far behind in terms of GDP per head.

Relative GDP per head

(US = 100)

Data for 1950, 1960, 1970 and 1980 from Maddison, The World Economy. A Millennium Perspective, 2001 (Table C1-c and C3-c), data for 1990, 2000 and 2010 from OECD.StatExtracts measured in current USD and current PPPs.

Own research

How to explain the relative decline after the magnificent catch up?

- Institutional mismatch? -

In my book on "Organisation and Evolution of Division of Labour" (1999, in German), I try to account for the rapid rise and relative decline of the Japanese economy arguing that Japan's labour market institutions and financial system formed during the high growth period had been well suited to achieve economic and technological catch-up, but were no longer adequate for an ageing society in a low growth environment. System complementarities and path dependencies have been preventing swift and effective adjustments in the institutional set-up that would have been necessary to sustain higher productivity growth.

- Consensus oriented governance as a barrier to growth? -

Japan is a consensus oriented society. If business has a clear goal as during economic catch-up, it is easy to decide on what to go for and how to do it. However, as a technological front runner there is much more uncertainty, higher risk and diversity of opinion. I explored the line of reasoning in a keynote speech delivered at a German-Japanese conference in Berlin ten years ago ("Facing Risk - The German and Japanese Economies at a Crossroad", 2003). I think it is still valid today.

- Demographic change? -

A young and growing population certainly supported Japan's economic miracle. The ageing of the population and the recently started decline are likely to slow down productivity growth, although the linkages are not well understood. Based on present labour participation ratios, I estimated that 0.3% of productivity growth per year would be necessary to sustain the level of GDP per head ("Demographic Change in Japan - Effects on the employment situation of elderly people", 2008, in German). You find more on demographic change here.

- Lack of internationalisation? -

Despite its dependence on energy and food imports, Japan trades relatively little with the rest of the world (see more on this under the topic "How open is Japan?"). The country seems to be not fully exploiting the advantages of an international division of labour and therefore foregoing further productity gains.

Input-output analysis

In a more technical paper on "Growth and Structural Change in the Japanese Economy 1985-2000" published in 2007, I apply the framework of input-output analysis to investigate what had been driving growth and structural change in the 1980s and 1990s. Major changes were the shift to export driven growth in the second half of the 1990s and the shift towards service industries accompanied by outsourcing trends and internationalization.

The impact of the March 11 disaster

Japan is not only a resource poor, but also disaster prone country. About 20% of all earthquakes with magnitude 6 or higher happen in Japan. The so far strongest ever measured quake in Japan occurred on March 11, 2011. It was accompanied by devastating Tsunamis and a nuclear catastrophe. The triple disaster leaving almost 20 000 people dead or missing, also hit the economy as production sites were destroyed and vital supply chains interrupted. However, the overall impact on economic activity and income turns out to be rather limited and far less severe than the downturn caused by the global financial crisis in 2008. I analyzed the economic consequences in a German paper with Jens Eilker published by VSJF in November 2011. An English abstract can be found at the website of EHESS in Paris and ISPI in Milan.