Highest debt ratio, but still lowest financing costs

The Japanese government is the most highly indebted among the OECD member states with a ratio of gross debt to GDP amounting to 205% in 2011. Still, investors were willing to buy 10 year Japanese government bonds at an implied interest rate of just 1.1%, the by far lowest yield among government bonds in the OECD. How can this be?

Ratio of gross debt to GDP and long-term government bond yields for selected OECD countries, 2011

Ratio of gross debt to GDP and long-term government bond yields for selected OECD countries, 2011

Data from OECD, Economic Outlook 91, 2012.

Rich country - poor government

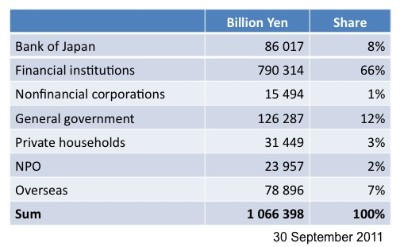

To answer the above question one has to look at who holds Japan's government debt.

Holders of Japanese government debt

Data from Bank of Japan, Flow of funds statistics.

It is basically the Japanese themselves. The debt is internally financed. The Japanese owe it to themselves, which means that the taxes needed to service the debt are taken from the Japanese tax payer and given to the Japanese bond holder. Of course both groups are not fully identical, because the bond holdings and tax payments vary across individuals. But as long as the Japanese can finance their debt internally, international markets should not become nervous.

Japanese banks and life insurance companies that hold public bonds in their portfolio as intermediaries have no interest in asking for higher yields. They would only harm themselves. The Bank of Japan estimated that a one percentage point rise in the interest rate would cause a loss of 6.3 trillion Yen to Japanese banks only. Why? Because a rise in the bond yield implies that bonds that were bought at lower interest rates will become less worth.

Will interest rates remain low?

The Bank of Japan is independent from the government. It has to ensure price stability and it is responsible for the stability of the financial system. It's present "near-zero" interest rate policy serves the interest of the government, stabilizes the financial system and fights deflation. What will happen, if inflation sets in? How will the BoJ then decide the conflict between price stability and stability of the financial system?

There is another mid to long term risk. The Japanese population is ageing, which means that in the aggregate private households will start dissolving their savings, thus reducing the governments ability to refinance debt internally.

When will this trend affect the governments financing costs? Will markets become nervous when Japan's current account turns negative, which might happen rather soon? Or will they be patient and wait until Japan's foreign net assets have melted down. These net assets, which have been accumulated over four decades of more or less steady current account surpluses, amounted to 241 trillion Yen end of September 2011, the highest net foreign asset position world wide.

Is the government doing enough?

In June 2010, the cabinet decided to cut the deficit over the next five years by half to 3.4% of GDP and to balance the budget in 2020. It is already foreseeable that the 2020 goal cannot be achieved without drastic tax increases and expenditure cuts. The planned increase of the value added tax from now 5% to first 8% and then 10% is not enough. Doi, Hoshi and Okimoto, in a NBER working paper published in 2011, conclude that Japan's fiscal situation is no longer sustainable.

But Japan's public debt is mainly financed by Japanese savings! The government could make a simple deal: It could offer domestic households to accept a write off of their financial assets directly or indirectly invested in government debt in return for an equivalent reduction in future tax payments. Why should such a deal not work?

Own research and lectures

I regularly take up the topic of government debt in papers and lectures on the Japanese economy. Already ten years ago, the question of whether Japan's government debt is sustainable or not was discussed. At that time, I wrote a paper on "Japan’s public debt" (2001). The numbers have changed, but the arguments and the lack of political determination remain.